On December 24, 2025, Colombia’s National Directorate of Taxes and Customs (DIAN) fundamentally altered the...

How Iran Moved $1 Billion Crypto Through the UK ?

In early 2026, investigations revealed that Iran’s Islamic Revolutionary Guard Corps (IRGC) successfully laundered approximately $1 billion through the United Kingdom’s financial system between 2023 and 2025. This operation utilized a hybrid network of UK-registered cryptocurrency exchanges and traditional bank accounts to evade international sanctions and fund regional proxies.

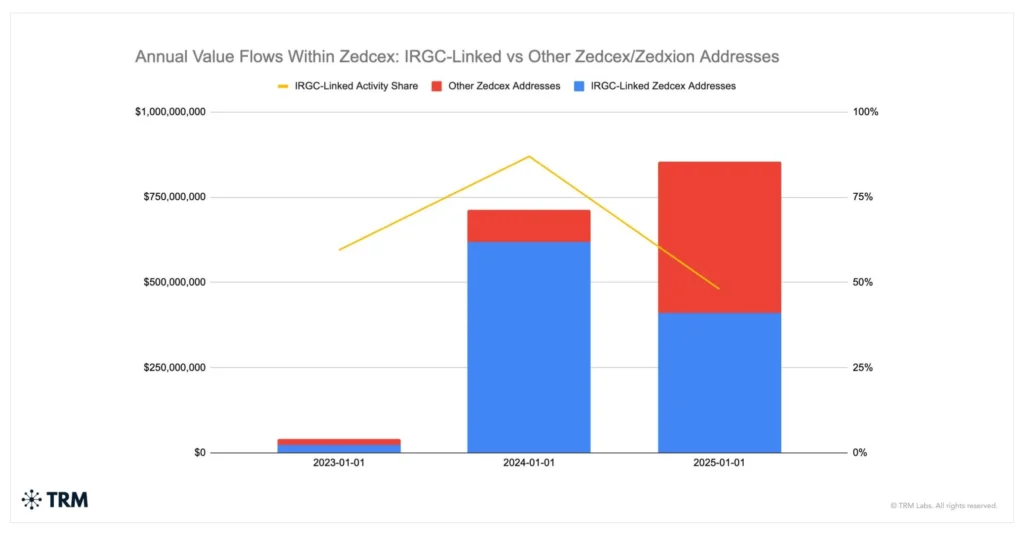

Image Source: https://www.trmlabs.com

1. Zedcex and Zedxion

The core of the digital evasion strategy involved two crypto exchanges incorporated in London: Zedcex Exchange Ltd and Zedxion Exchange Ltd.

- While presenting themselves as legitimate platforms, these entities processed $1 billion in illicit flows, with IRGC-linked transactions accounting for up to 87% of their volume in 2024.

- The network primarily utilized Tether (USDT) on the TRON blockchain. This choice allowed for rapid, low-cost settlements that bypassed the US banking system and SWIFT monitoring.

- Blockchain forensics linked the operations to Babak Zanjani, a sanctioned Iranian billionaire known for managing the regime’s oil-for-cash networks. Zanjani was listed as a person of significant control for Zedxion, signaling direct state-level coordination.

2. The Banking Loophole: Lloyds and Santander

Parallel to the crypto pipeline, the IRGC exploited traditional finance through the state-owned Petrochemical Commercial Company (PCC). Despite being sanctioned by the US since 2018, PCC operated in the UK through a complex web of front companies.

- Front Companies: Two key entities, Pisco UK and Aria Associates, held business accounts with Santander UK and Lloyds Bank, respectively.

- Ownership Concealment: These companies were legally owned by straw men nominee directors who signed “trustee agreements” to hold the shares on behalf of PCC, effectively masking the sanctioned beneficial owners from bank compliance checks.

- Flow of Funds: These accounts were used to receive payments from Chinese shell companies (like Black Tulip Trading) for Iranian oil exports, laundering the proceeds into the Western financial system.

3. Institutional & Regulatory Failure

The success of this pipeline highlights critical systemic vulnerabilities in the UK:

- Companies House Blind Spots: Zedcex and Zedxion registered using virtual offices at 71-75 Shelton Street a notorious address for shell companies and filed “dormant accounts” to tax authorities while processing hundreds of millions of dollars on-chain.

- Sanctions Lag: The UK did not immediately mirror all US designations regarding PCC’s subsidiaries, creating a regulatory “grey zone” that allowed these entities to operate legally in London while being illegal under US law.

- Compliance Gaps: Banks failed to identify the ultimate beneficial owners (UBOs) behind the trustee agreements, allowing sanctioned entities to access Tier 1 banking services.

The funds moved through this “London Laundromat” are directly linked to the IRGC’s “Resistance Economy.” The liquidity provided by this network supports the procurement of components for Iran’s missile program and funds regional proxies, including Hezbollah and the Houthis.